Casella Waste Systems, Inc. to Acquire Select Solid Waste Operations From GFL Environmental Inc. That Will Expand Footprint Into Adjacent Markets and Provide a Platform for Future Growth

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/dfbe7bda-d62f-4692-a375-9215c5184f68

“Today’s announcement marks an important step forward in the company’s growth strategy by using the strength of our balance sheet and proven capital discipline to make a compelling investment,” said

“We have worked with the GFL team to conduct extensive due diligence and to start a collaborative integration and transition planning process,” Casella said. “Over the last five years we have built a strong team focused on successfully integrating and driving returns from acquisitions. In addition, our existing team includes several talented professionals who have experience with these specific operations and markets, which provides us even more confidence around a successful integration process to drive further shareholder returns.”

“We look forward to welcoming the hardworking GFL employees to our team,” Casella said. “And, we look forward to the opportunity to provide excellent service to our new customers and the communities that GFL currently serves in these markets.”

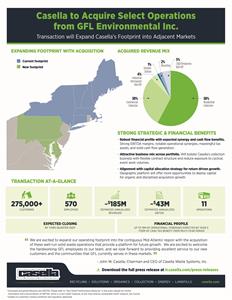

Strong Strategic and Financial Benefits

- Expands footprint into contiguous markets for additional growth opportunities. The pending acquisition of solid waste assets in the

Pennsylvania ,Maryland andDelaware markets is a natural extension to Casella’s existing footprint in the Northeast and offers future organic and inorganic growth opportunities. Casella’s resource management approach to providing value to its customers through sustainable solutions represents great potential to grow its commercial and industrial segments. - Robust financial profile with synergy and cash flow benefits. The operations and transaction structure are expected to provide solid financial benefits that will help to drive continued strong cash flow growth. Casella expects the acquired operations to generate approximately

$185 million of revenues and$43 million of EBITDA1 during the first 12-months. In addition, Casella expects to generate approximately$8 million of incremental annual synergies and benefits by year three of operations through internalizing certain volumes into its disposal network and capturing fleet automation efficiencies. Further, given the structure of the transaction, it is expected that the acquisition will create significant cash tax benefits to Casella, estimated to be greater than$130 million of savings over a multi-year period. - Attractive business mix across the portfolio. Approximately 80% of the revenues to be acquired are currently generated in the open market from commercial collection and subscription residential collection customers. Further, approximately 5% of the revenues to be acquired are currently generated from construction and development activity which is expected to further reduce exposure to more cyclical and event-driven lines of business on a consolidated pro forma basis.

- Alignment with capital allocation strategy for return driven growth. The transaction is consistent with Casella’s 2024 strategic plan of opportunistically deploying capital at strong, risk-adjusted return levels to create long term shareholder value.

Financing of the Acquisition

The acquisition is not subject to any financing conditions and Casella expects to fund the purchase price through a combination of cash on hand, revolving credit facility borrowings, and from a planned new Term Loan A under its existing senior secured credit facility. Casella received a bridge financing commitment from

Approvals and Closing Timeline

The acquisition was unanimously approved by Casella’s Board of Directors and is expected to close by the third quarter of 2023, subject to customary closing conditions, including regulatory approvals.

Casella Confirms Previously Announced First Quarter 2023 Earnings Call

About

Safe Harbor Statement

Certain matters discussed in this press release, including but not limited to, the statements regarding our intentions, beliefs or current expectations concerning, among other things, projections as to the anticipated benefits of the proposed transaction; the anticipated impact of the proposed transaction on the Company’s business and future financial and operating results; the expected amount and timing of synergies from the proposed transaction; and the anticipated closing date for the proposed transaction are "forward-looking statements". These forward-looking statements can generally be identified as such by the context of the statements, including words such as “believe,” “expect,” “anticipate,” “plan,” “may,” “would,” “intend,” “estimate,” “will,” “guidance” and other similar expressions, whether in the negative or affirmative. These forward-looking statements are based on current expectations, estimates, forecasts and projections about the industry and markets in which the Company operates and management’s beliefs and assumptions. The Company cannot guarantee that it actually will achieve the financial results, plans, intentions, expectations or guidance disclosed in the forward-looking statements made. Such forward-looking statements, and all phases of the Company’s operations, involve a number of risks and uncertainties, any one or more of which could cause actual results to differ materially from those described in its forward-looking statements.

Such risks and uncertainties include or relate to, among other things, the following: failure to satisfy all closing conditions, including receipt of regulatory approvals, that may prevent closing of the transaction; the Company may not fully recognize the expected financial benefits from the acquisition due to an inability to recognize operational cost savings, market factors, landfill internalization benefits, or due to competitive or economic factors outside its control which may impact revenue and costs, or for other reasons; and the Company may be unable to achieve its acquisition goals as part of the 2024 strategic plan due to competition for attractive targets or an inability to reach agreement with potential targets on pricing or other terms.

There are a number of other important risks and uncertainties that could cause the Company’s actual results to differ materially from those indicated by such forward-looking statements. These additional risks and uncertainties include, without limitation, those detailed in Item 1A. “Risk Factors” in the Company’s most recently filed Form 10-K for the fiscal year ended

The Company undertakes no obligation to update publicly any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

Non-GAAP Performance Measures

In addition to disclosing financial results prepared in accordance with generally accepted accounting principles in

| Non-GAAP Reconciliation of Acquired estimated EBITDA to Acquired estimated Net Income1 | |||||

| $ in millions | Year 1 Annualized |

||||

| Net income | $ | 14 | |||

| Net income as a percentage of revenues | 7.6 | % | |||

| Provision for income taxes | - | ||||

| Interest expense, net | - | ||||

| Depreciation and amortization | 29 | ||||

| EBITDA | $ | 43 | |||

| 1 Estimated based upon pro forma initial 12-month period. | |||||

Non-GAAP Liquidity Measures

We present non-GAAP liquidity measures such as Consolidated EBITDA, Consolidated Funded Debt, Net and Consolidated Net Leverage Ratio that provide an understanding of the Company’s liquidity because we consider them important supplemental measures of our liquidity that are frequently used by securities analysts, investors and other interested parties in the evaluation of our cash flow generation from our core operations that are then available to be deployed for strategic acquisitions, growth, investments, development projects, unusual landfill closures, site improvements and remediation, and strengthening our balance sheet through paying down debt. We also believe that identifying the impact of certain items as adjustments provides more transparency and comparability across periods. Management uses non-GAAP liquidity measures to further understand our cash flow provided by operating activities after certain expenditures along with our consolidated net leverage and believes that these measures demonstrate our ability to execute on our strategic initiatives. We believe that providing such non-GAAP liquidity measures to investors, in addition to corresponding cash flow statement measures, affords investors the benefit of viewing our liquidity using the same financial metrics that the management team uses in making many key decisions and understanding how the core business and cash flow generation has performed.

| Debt and Credit Metrics1 | ||||||||||||

| $ in millions | Actual 12 months ended 2022 |

Acquisition & Related Financing |

Pro forma 12 months ended |

|||||||||

| Reconciliation of Consolidated EBITDA (as defined by the Company's Amended and Restated Credit Agreement2) to Net Cash Provided by Operating Activities: | ||||||||||||

| Net Cash Provided by Operating Activities | $ | 217 | $ | 43 | $ | 260 | ||||||

| Changes in assets and liabilities, net of effects of acquisitions and divestitures | 11 | - | 11 | |||||||||

| Stock based compensation and related severance expense, net of excess tax benefit | (8 | ) | - | (8 | ) | |||||||

| Operating lease right-of-use assets expense | (5 | ) | - | (5 | ) | |||||||

| Disposition of assets, other items and charges, net | (1 | ) | - | (1 | ) | |||||||

| Interest expense, less amortization of debt issuance costs and discount on long-term debt | 22 | - | 22 | |||||||||

| Provision for income taxes, net of deferred taxes | 5 | - | 5 | |||||||||

| Adjustments as allowed by the applicable credit facility agreement | 15 | - | 15 | |||||||||

| Consolidated EBITDA | $ | 257 | $ | 43 | $ | 300 | ||||||

| Debt and Leverage Metrics: | ||||||||||||

| Consolidated Funded Debt, net | $ | 534 | $ | 544 | $ | 1,078 | ||||||

| Consolidated Net Leverage Ratio (Consolidated Funded Debt, net divided by Consolidated EBITDA) | 2.08x | 3.59x | ||||||||||

| 1 Estimated based upon pro forma capitalization, including estimated fees and transaction costs. | ||||||||||||

| 2 As calculated per the anticipated |

||||||||||||

_________________________________

1 Please refer to “Non-GAAP Performance Measures” below for further information and a reconciliation of EBITDA, which is a non-GAAP measure, to the most directly comparable GAAP measure, net income.

2 Please refer to “Non-GAAP Liquidity Measures” below for further information about consolidated funded debt, net and consolidated EBITDA (as defined by the Company’s Amended and Restated Credit Agreement) and a reconciliation of consolidated EBITDA, to the most directly comparable GAAP measure, net cash provided by operating activities. Consolidated net leverage ratio (the “Net Leverage Ratio”) is calculated as consolidated funded debt, net of unencumbered cash and cash equivalents in excess of

Source: Casella Waste Systems, Inc.